One year of Quantitativo

From sharing strategies to building a community: how ~5,000 readers, ~30 strategies, and one big idea shaped our first year

The idea

“Either write something worth reading or do something worth writing”. Benjamin Franklin

Benjamin Franklin was a printer, inventor, diplomat, and my favorite Founding Father. But more than that, he was a lifelong student of self-improvement. He believed in the power of ideas, disciplined action, and sharing knowledge to make the world better.

This week, we celebrate one year of Quantitativo! I chose to open with Franklin because, as we enter our second year, we're introducing a few innovations that reminded me of his spirit of learning and experimentation. These include:

Study Group via Zoom

Sharing what’s next on the implementation roadmap

Sharing live performance data from strategies in production

1. Study Group via Zoom

As many of you requested, a few weeks ago I launched a course that walks through some of my codebase step by step. It's designed for readers who want to develop quant strategies using the same approach I’ve shared here.

The feedback has been overwhelmingly positive. Thank you! I've added some spontaneous testimonials at the end of this message so everyone can get a sense of the response 🙂

The final 10 seats are still available. The cohort already has 40 students, and I’ll be closing enrollment this Monday. So if you're interested, now’s the time to check it out:

One of the main requests from the first students was to create a community space.

A private community for systematic traders to explore ideas, exchange insights, and discuss the technical and strategic challenges of building real trading systems.

So, we launched the community… and it’s flourishing!

It’s become a space for daily conversations about alpha research, deeper technical implementation, infrastructure design, and more. One of the first ideas that emerged was to start a Study Group via Zoom.

The idea is simple: each week (or every other week), one person reads a paper, prepares a short presentation (15 minutes max), and shares it with the group. Then we discuss how to implement it in practice.

For the kickoff session, I’ll present the paper “Short-Term Basis Reversal” by Rossi, Zhang, and Zhu (2025). The session will happen in the second week of June. I’ll share both the paper summary and my own implementation so we can discuss the practical side together.

The vision is to grow this community from the current 40 students into a broader group of people who are serious about studying, developing, and implementing quantitative trading strategies. Let’s see where this leads.

This initiative reminded me of Ben Franklin’s Junto (also known as the Leather Apron Club). In 1727, at the age of 20, Franklin founded the Junto, a club for mutual improvement. It brought together a small group of artisans and tradesmen who shared a desire for self-education, civic responsibility, and intellectual exchange. They met weekly to discuss moral, political, scientific, and economic questions.

But the Junto wasn’t just academic. It was about practical wisdom and intellectual humility. And the community he started lasted nearly half a century.

2. Sharing what’s next on the implementation roadmap

Over the past year, I’ve shared nearly 30 strategy implementations here. These started as blog posts and gradually shifted toward academic paper implementations, which have become a clear favorite within the community.

So, I’ll continue to implement and share interesting papers, along with my take on them.

I have the habit of reading 1-2 papers per week. I choose them from my personal collection, which I curate by skimming 5-10 new research papers each day and selecting up to 3 to add to the library.

Recently, someone in the community asked how I decide which papers to test. After explaining my process, I began sharing a few of my selected papers, and, to my surprise, the response was highly positive.

I’ll continue writing my implementations (“do something worth writing,” as Ben Franklin would say). And starting with today’s piece, I’ll also begin periodically sharing research ideas from my library that are currently on the implementation roadmap (“write something worth reading,” as Ben would put it).

Here are the new additions I have gathered over the past few weeks:

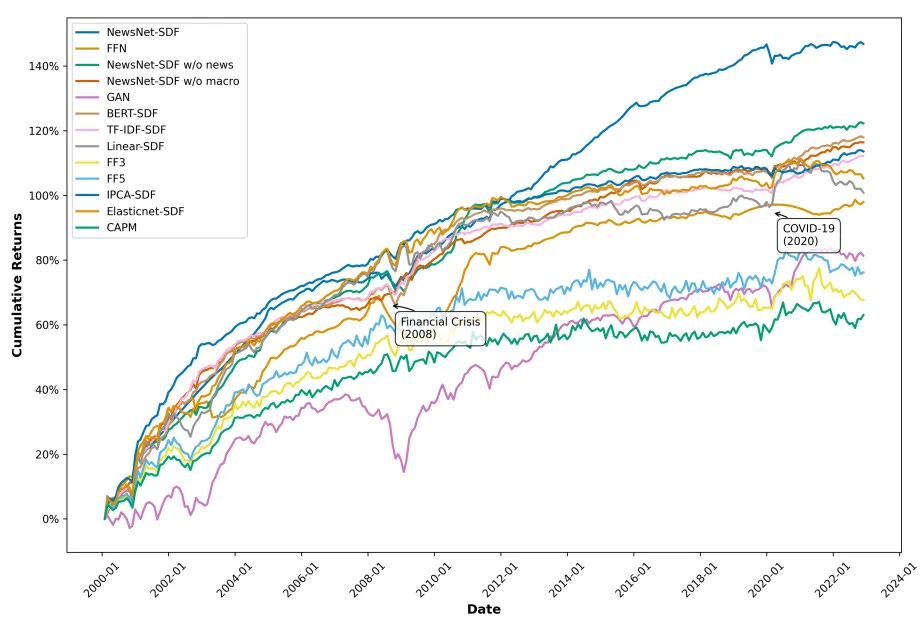

2.5 million headlines. A Sharpe ratio of 2.80.

A new paper just dropped that integrates pretrained language model embeddings into a stochastic discount factor (SDF) framework using adversarial networks.

The result? A model that outperforms CAPM by 471%, reduces pricing errors by 74% compared to Fama-French 5-factor, and shows that financial news holds more predictive power than macro data.

Text embeddings extracted from news lead returns by 2-3 weeks, and rank among the most important features in asset pricing.

High attention is a warning sign.

A new interesting study finds that daily investor sentiment and attention on StockTwits, Twitter, and Seeking Alpha move markets in opposite ways: high attention predicts continued losses, while high sentiment signals mean-reverting optimism. A trading strategy based on these two signals delivered a Sharpe ratio of 1.2 and outperformed traditional attention metrics.

Market Signals from Social Media (Cookson et al., 2025)

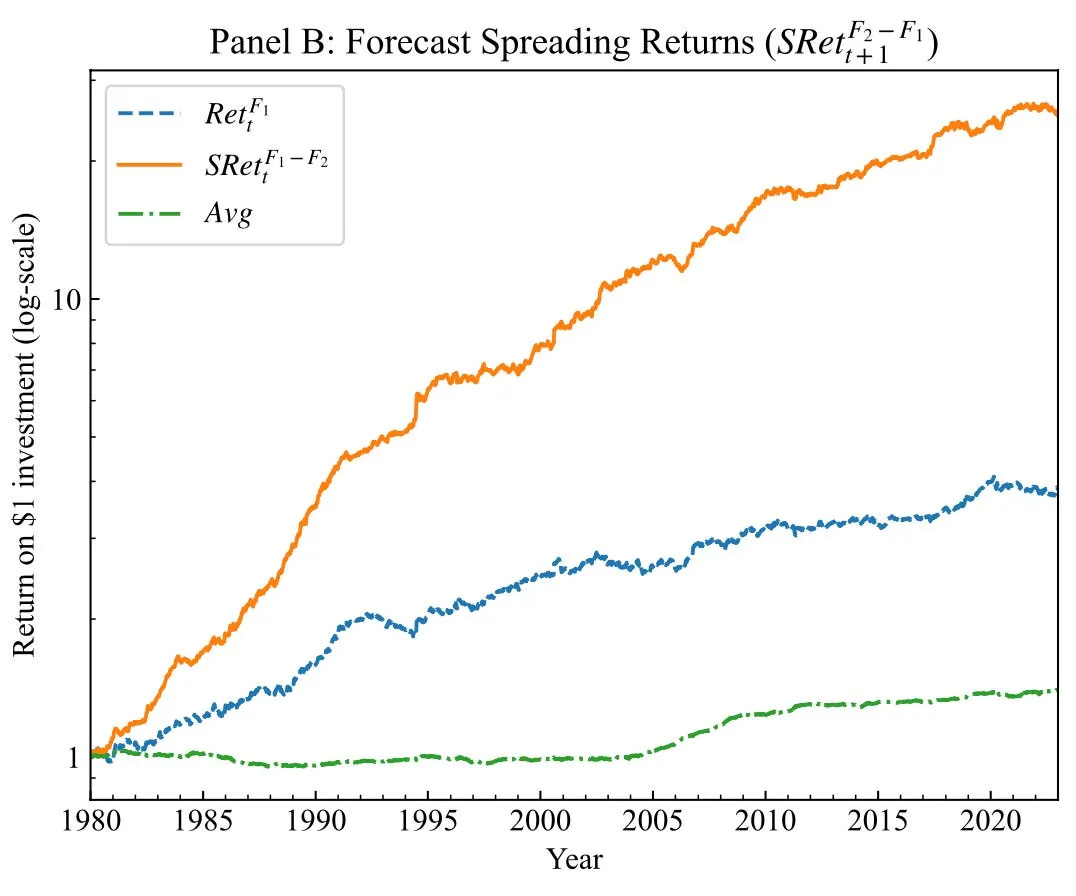

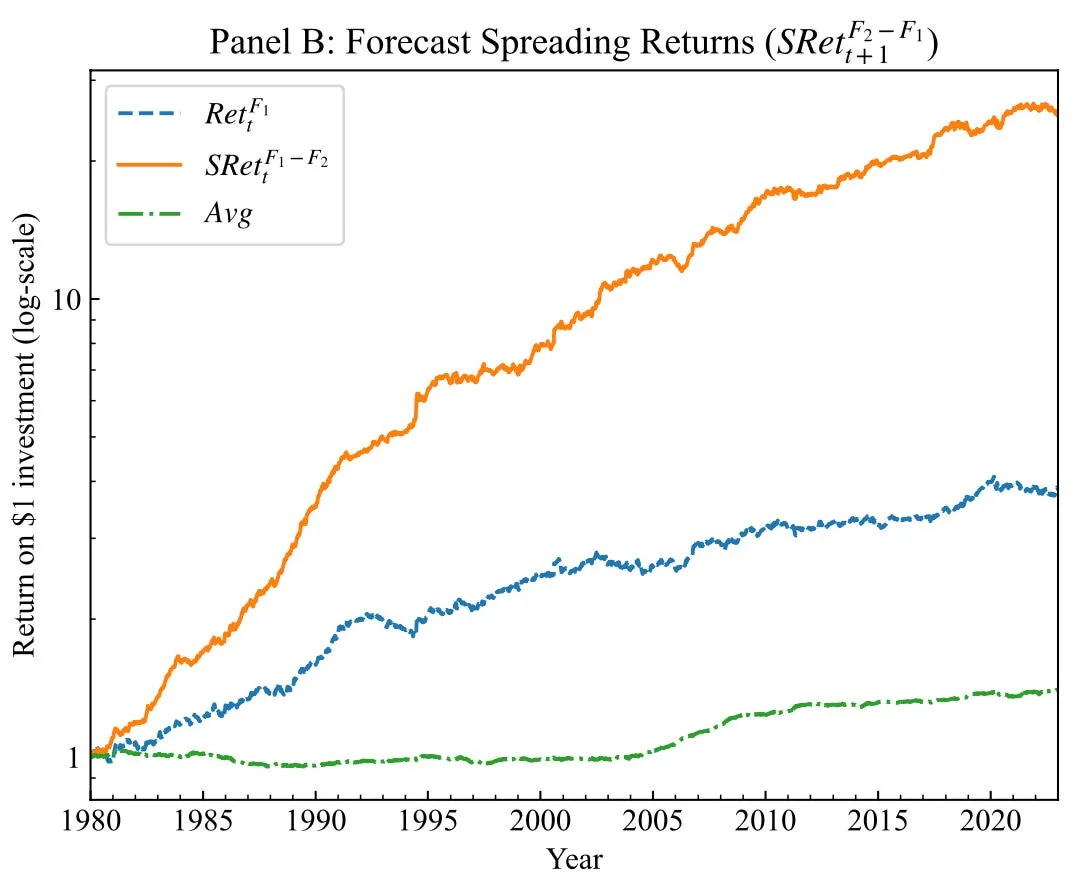

One-week holding. 17.6% annual returns and 1.42 Sharpe. Zero exposure to known risk factors.

A new paper reveals that the spread between front- and second-month futures reverses week to week. This “short-term basis reversal” is:

Predictable,

Unexplained by carry or momentum,

Strongest when volatility is high.

The strategy? Go against last week’s spread. It works across commodities, bonds, and even stock index futures.

Short-Term Basis Reversal by Rossi, Zhang, and Zhu (2025)

This paper is the focus of our first Study Group via Zoom.

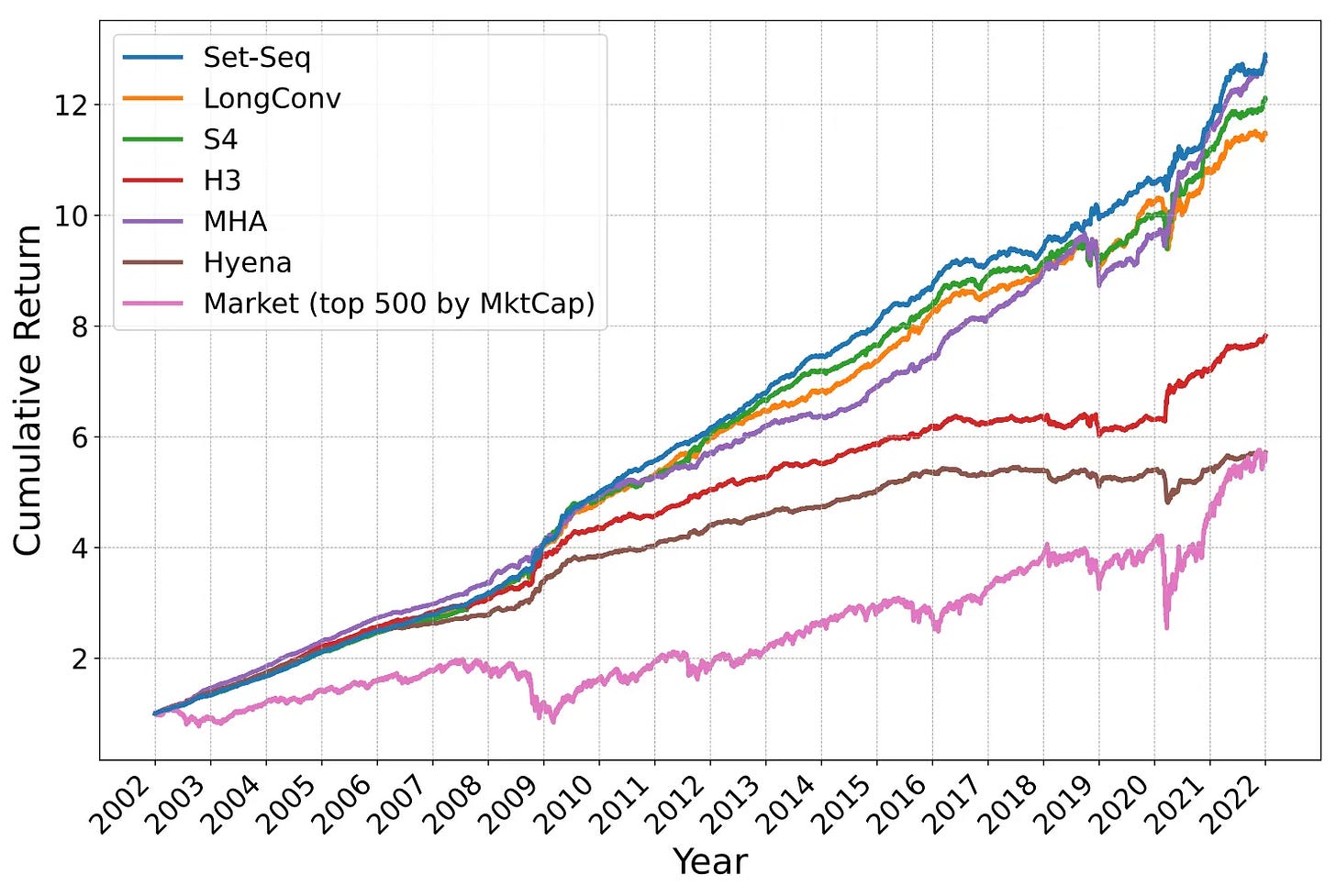

4.82 Sharpe. 42% better than CNNs built for stocks.

This new paper drops a clever insight: financial time series (like stocks or loans) should be treated as sets, not fixed sequences.

The proposed Set-Sequence model learns cross-sectional dependencies without handcrafted features. It crushes benchmarks on:

Stock return prediction (36,600 equities),

Mortgage risk (5M loan-months),

Synthetic contagion (1,000-unit default simulation).

Efficient. Interpretable. Exchangeable. The future of multi-series forecasting might look like this.

A Set-Sequence Model for Time Series, by Elliot L. Epstein, Apaar Sadhwani, and Kay Giesecke.

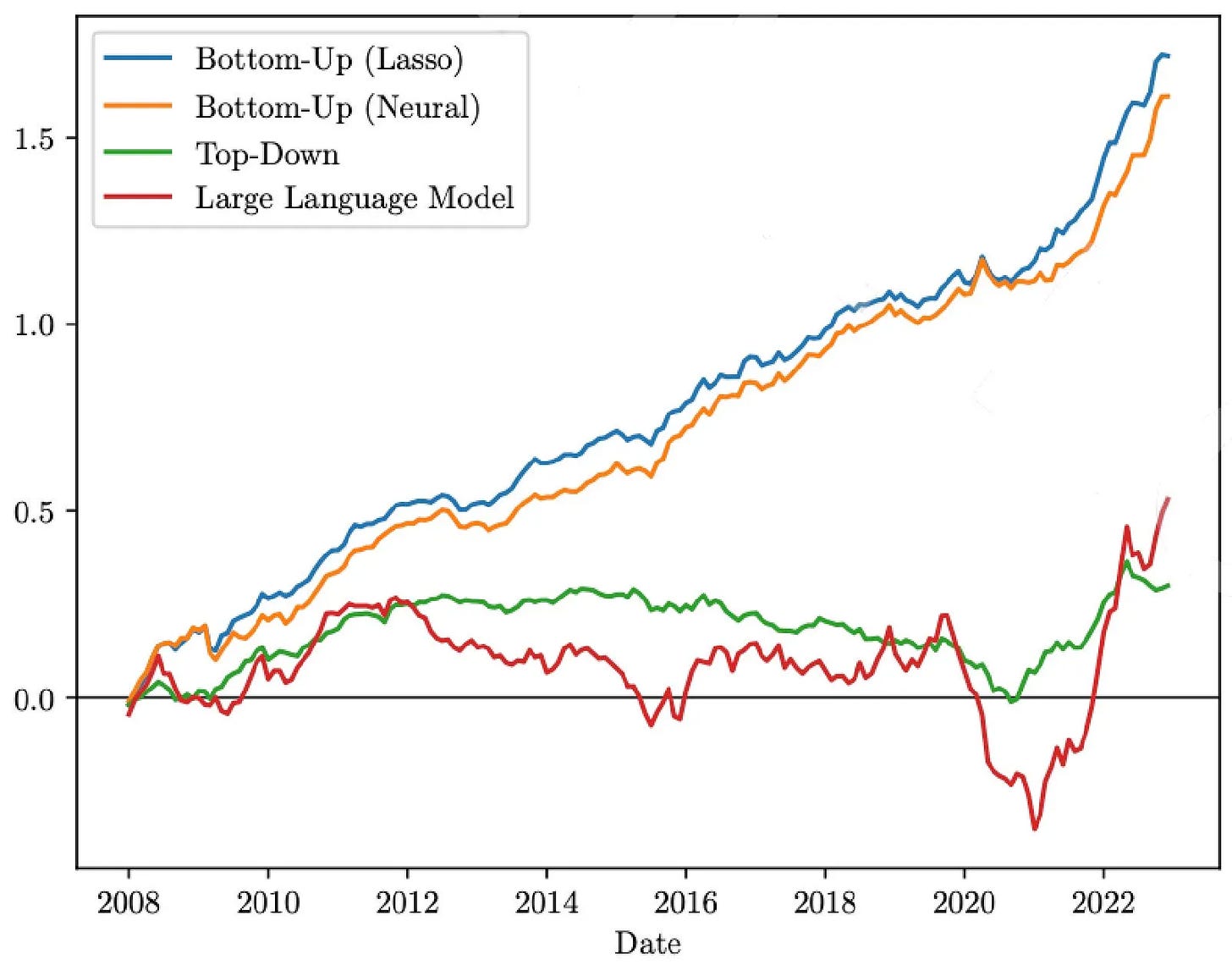

A simple word count model beats BERT and sentiment dictionaries. 1.86 Sharpe. Long Lasso, short LLMs.

This new paper builds a bottom-up dictionary, selecting the most predictive words in 10-Ks using lasso regressions.

The result? A factor portfolio with:

1% monthly returns,

1.86 Sharpe (equal-weight),

Minimal overlap with Fama-French 5.

Outperforms:

Top-down sentiment models,

Large language model embeddings (BERT),

Even neural nets with the same input.

The winning signal? Words like currency, oil, restructuring, and research.

3. Sharing live performance data from strategies in production

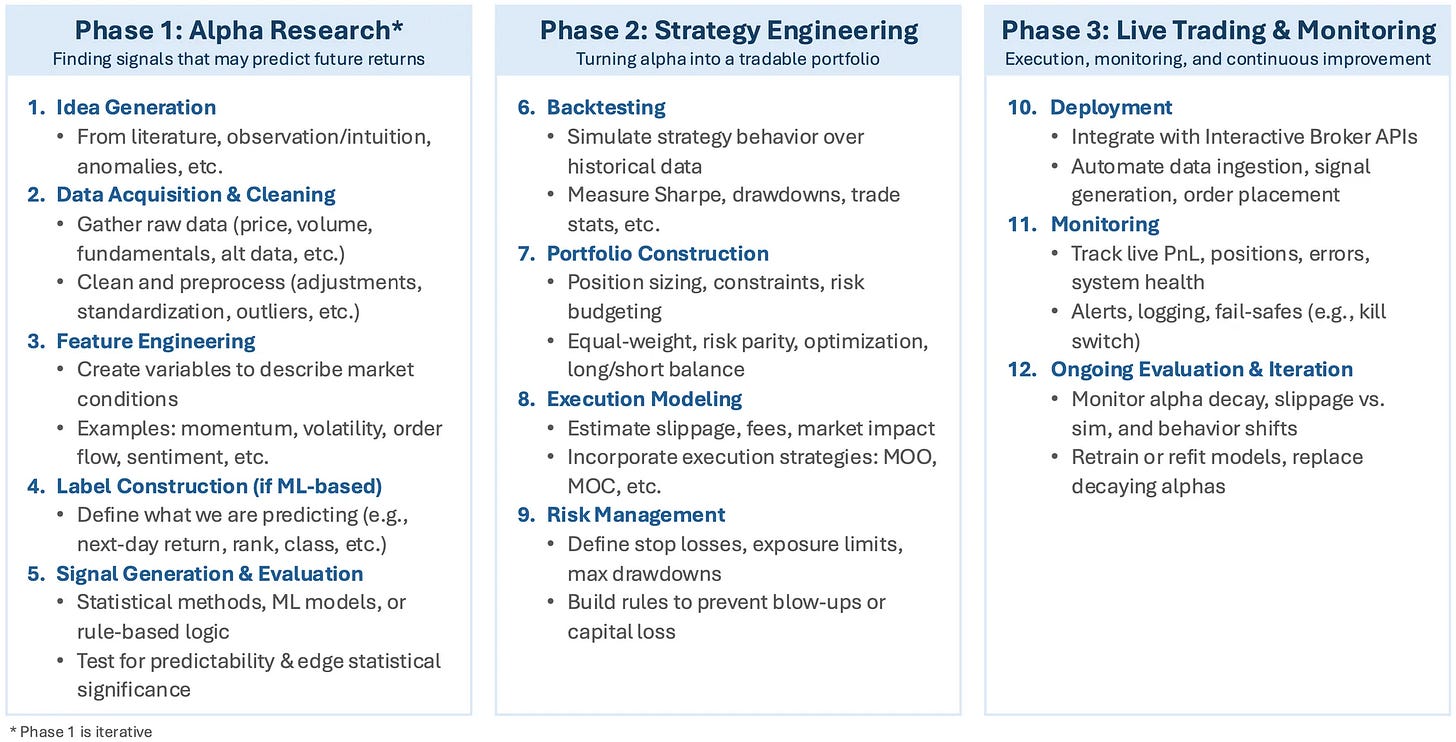

If I had to summarize the strategy development process I follow, it would look like this:

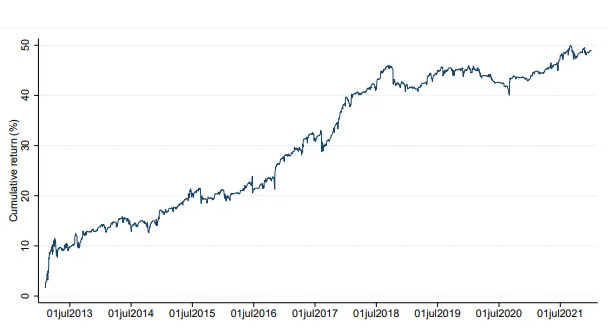

After a year of testing, only a handful of strategies made it through. These are now in production, with a few million dollars allocated to them.

Starting this year, I also plan to begin sharing live performance data for these strategies. This will roll out later in the year.

Final thoughts

It’s been an incredible first year.

Since launching Quantitativo, we’ve connected with nearly 5,000 people: readers, students, and fellow traders from all over the world. More important than any strategy I’ve shared, what truly stood out were the relationships built along the way: new friends, thoughtful conversations, and meaningful collaborations that helped shape many of the ideas shared.

What began as a simple idea (sharing the process of developing trading strategies) has evolved into a growing community of people who are serious about building conviction through research, iteration, and implementation.

At the core of Quantitativo is a simple belief:

The more strategies we test, the higher our odds of achieving above-average returns.

Our goal isn’t to hand out plug-and-play systems. It’s to spark curiosity, build skill, and help each of us become the kind of person who’s always learning, questioning, and creating.

Because strategies come and go. But the habit of developing and testing ideas, and the relationships we build along the way, are what truly endure.

Thank you for being part of this journey.

I'm excited for what’s ahead, and I look forward to meeting more of you, exchanging ideas, and continuing to build great things together.

Cheers,

Carlos

P.S. As mentioned earlier, here are a few spontaneous testimonials from early users:

Thanks again for the incredible feedback! It really makes my day. :)

When are you holding the Zoom calls and do you record them?

Thank you so much for your continuous work! You mentioned you would look through new papers everyday and select the top ones. Would you mind sharing which journal or blog or platform you look for papers? Also is there any criteria you’d recommend in selecting good papers in your opinion? Thank you very much!